In recent years, global economic growth and international trade have both slowed down, with many downside risks ahead. What are the major uncertainties facing the global economy, and what impact will they have on monetary policies around the globe? Negative interest rate policies have breached the zero lower bound of policy rate and posed serious challenge to traditional interest rate policy. How to assess the effect of the policies now being implemented in some countries? At the same time, fiscal policy is receiving more attention as a potentially more effective tool for economic recovery. How should monetary policy and fiscal policy be coordinated to achieve higher economic growth?

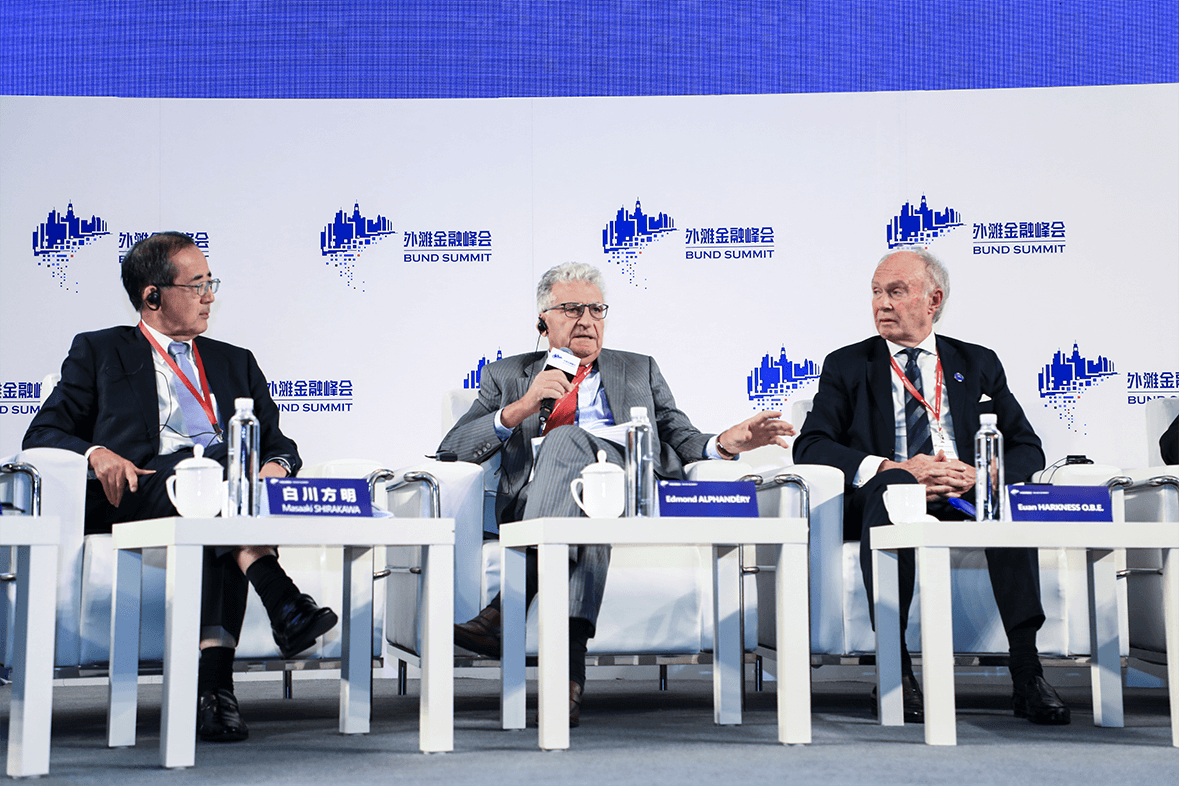

Policymakers and academics are now calling for expansionary fiscal policy. But again, the fiscal policy itself is front-loading strategy. And the only difference is whether demand brought forward from the future is private or public. But essentially it is front-loading. And of course, this fiscal policy should be directed toward productive investment. If that is the case, then it could work. But based on my past experience, I’m very skeptical. But is expansionary monetary policy really a solution to the current problem? For the reason I mentioned, I’m very skeptical. My point is the effort at raising productivity is crucially important but nonetheless, people are flirted with deflation or another policy.

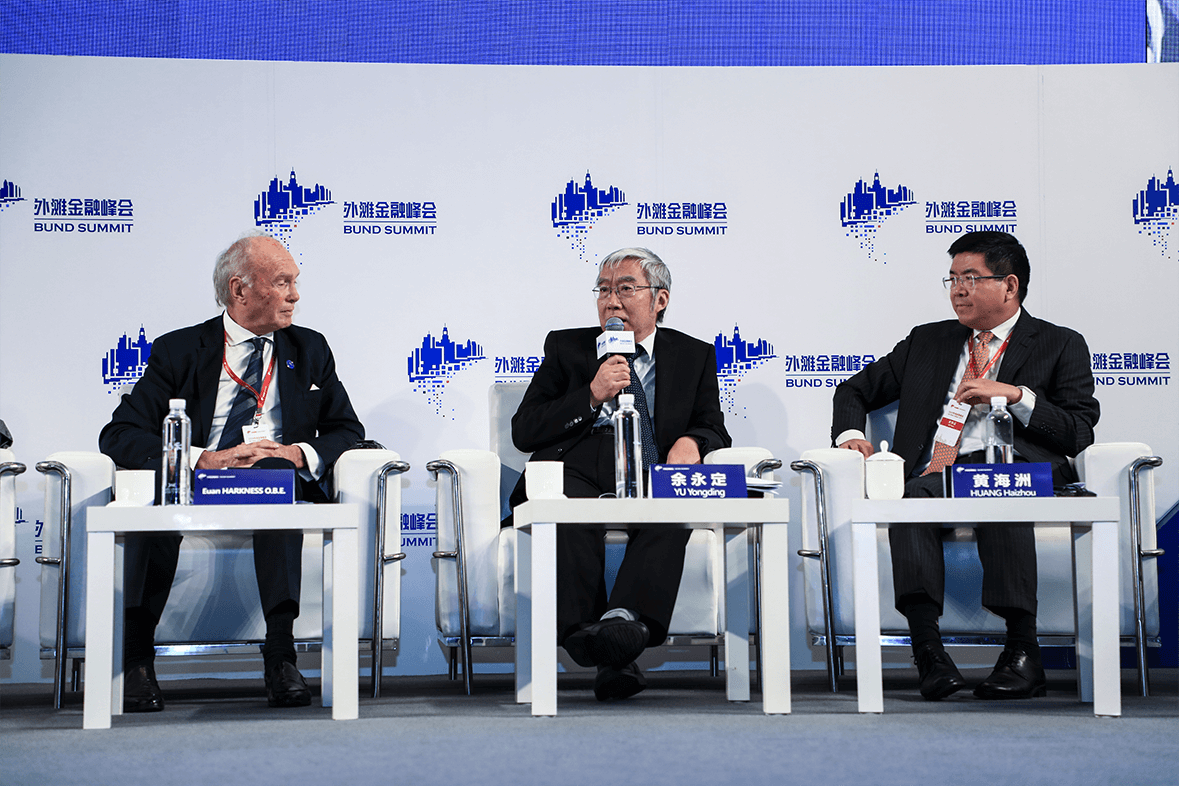

Masaaki SHIRAKAWA

Former Governor, Bank of Japan

Indeed, return to more conventional monetary policy remains risky, but remaining with a prolonged period of easing monetary conditions leads a financial system into vulnerabilities. It enters into dangerous territories deeper and deeper.

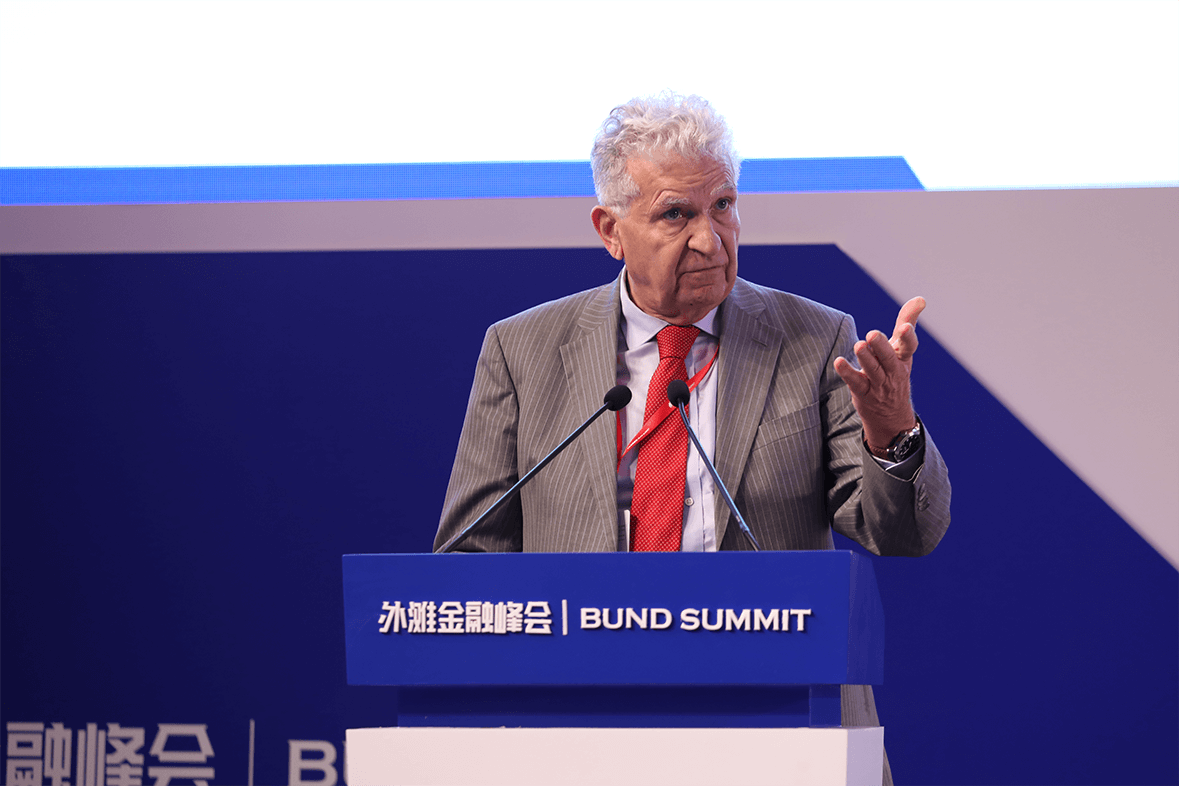

Edmond ALPHANDÉRY

Chairman, Euro50 Group; Former French Minister of Economy

Watch the highlights

(1).jpg)